Will Santa Rally?

12/12/2018

Dear Reader,

The past four months have seen much heightened volatility in world stock markets. There have been periods of precipitous falls replete with the usual hubris of the expert commentator. It is, though, a credit to the clients of this firm that you remain sanguine and have not called upon us to provide soothing messages of reassurance – to hear the somewhat trite “investing is for the long-term”, or some such words. (I would hope that we might be a touch more sophisticated in our communiqué!)

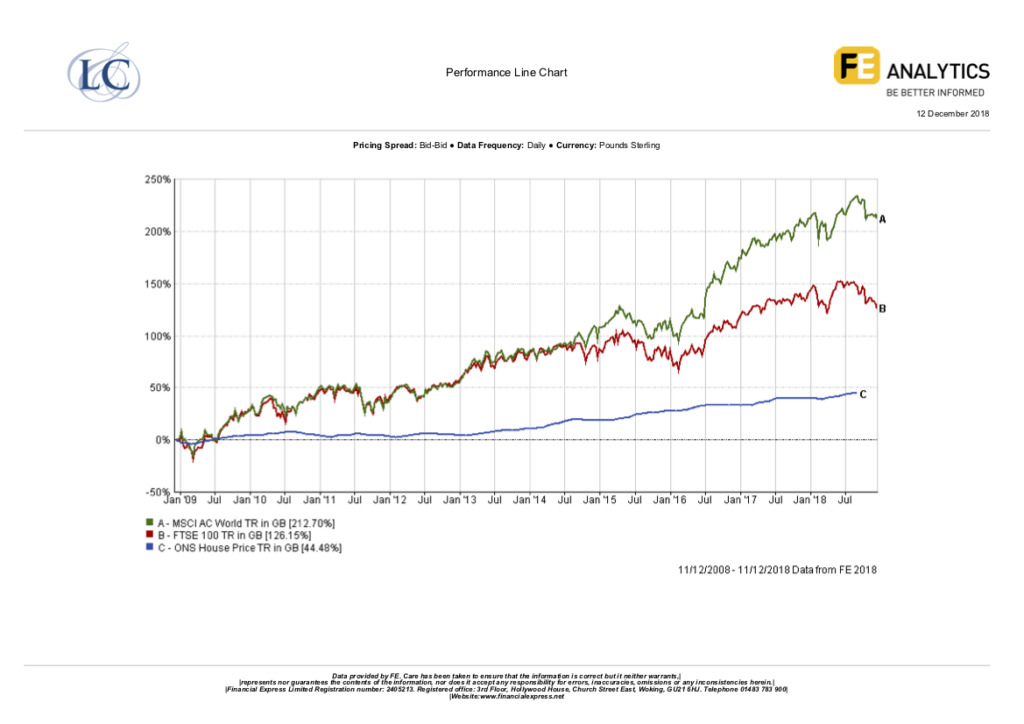

What we are all experiencing is volatility. This is a hackneyed expression (I plead guilty) but the reality of volatility is unpleasant. It reminds us of the savagery of markets. It reminds us to be patient. It also reminds us to be confident. Understandably, the latter is in short supply with the noise and chaos of Brexit and the nascent US/Sino trade war. However, if one steps back one would notice that the stockmarkets are only giving up the most recent gains; even the beleaguered FTSE100 index has risen by 124% over the past 10 years (the green line). It is interesting to note that over the same period everyone’s favourite investment, the house price (the blue line), has increased by a mere 44% (as measured by the Office for National Statistics). The graph, below, demonstrates this point.

I read with some amusement the plethora of articles issued last Friday about the inverted yield-curve (note to self: get out more in 2019). The commentators were predicting a recession in 12-18 months time because this is what alwayshappens. Now, I’m not saying that there definitely shall not be a recession (recessions, generally, force equity and bond prices lower). It is the concept that because something happens then it must always repeat itself in the future. If I have learned one thing in 34 years it is to not rely on supposition. It is the facts that matter. Indeed, the Fed increased rates too far, too soon. Remember Trump’s choice comments about the Fed:”The problem I have is with the Fed. The Fed is going wild. They’re raising interest rates and it’s ridiculous”. Reducing the steepness of the planned increases in interest rates flattened the yield curve. However, the corollary was a collapse in bank share prices (they might not wish to lend so much, and hence make less money, if longer rates are not at a healthy premium). Certainly, there was a sharp fall in bank shares prices last week. Whether this is a portent of doom, though, I doubt. More likely is that the yield curve will steepen.

The rate of interest set by central banks is the key to the pricing and valuation of assets. As long as these remain low, equity and bond values shall be supported. It does look as though the Fed are backtracking on their word and are ‘within shouting distance of neutral’, meaning that rates would not rise further in the short term. Interestingly it seems to me that the Fed has been influenced by the markets, rather than the other way round.

It should not be a surprise to any reader that UK stockmarket has faired worse than most. Whilst it is impossible, and undoudbtedy disingenuous, to predict the long-term effect of Brexit the short-term effect is a semi-paralysis within the UK. Once there is an outcome the fog shall lift. If you refer back to the graph, above, note how world stockmarkets (the green line) have diverged from world stockmarkets (the red line). The red line is, of course, the FTSE100 index and is a proxy for world stockmarkets. The UK stockmarket appears to be rather inexpensive.

Your portfolios are constructed and managed from a global perspective, with a diversity of assets. Whilst they have weathered the recent storm well, the storm is likely to continue for a little while yet. However, we shall remain vigilant and active in our management to ensure the outcomes that you expect. Of course, it is that festive time of year and there is still time for the ‘Santa Rally’. I suspect that he might be a little subdued this year.

Finally, we have moved into a smart office in the centre of Woodbridge. It is lovely market town on the banks of the Deben, close to the east coast and, given that we are within a stone’s throw from the railway station and that our door is always open, we should be delighted to offer you our hospitality. The address is shown below and the new telephone no. is 01394 368 140. There shall be a note delivered to our clients with all the new contact details.

Please do contact us should you wish to discuss any matter or, indeed, to hear our words of mollification!

Could I wish all my readers every joy over Christmas and the New Year.

Andrew Longbon,

For, and on behalf of, Longbon & Company